Trump Accounts became a reality when H.R. 1, also known as the “One Big Beautiful Bill Act,” was signed by President Trump on July 4, 2025. Since the legislation allows companies to contribute to these accounts, plan sponsors are raising important questions. Here, we address some of the most common inquiries.

What is a Trump Account?

A Trump Account is a starter retirement savings account created specifically for children. As part of a federal pilot program, children born in the U.S. between January 1, 2025, and December 31, 2028, will receive a one-time $1,000 contribution from the federal government to initiate their accounts. The goal is to promote long-term savings and investment habits from an early age.

Key points to consider:

- No immediate contributions: Contributions to Trump Accounts are not permitted until July 2026, giving plan sponsors time to evaluate their approach and prepare accordingly.

- Regulatory guidance is needed: The legislation requires regulatory action to clarify administrative procedures. Additional guidance is expected, which will help plan sponsors make more informed decisions about implementation and compliance.

Common questions plans sponsors have about Trump Accounts

Q1: Will parents contribute to Trump Accounts given other savings options?

A1: A Trump Account may be created for any child under the age of 18 who has a Social Security Number. However, under a pilot program, only children born beginning in 2025 and through 2028 will receive a $1,000 contribution from the federal government. Excluding this initial federal government contribution, rollovers from other Trump Accounts, and certain exempt contributions from states’ governments and charitable organizations, parents and others may contribute up to $5,000 annually per child. This limit will be adjusted each year for inflation.

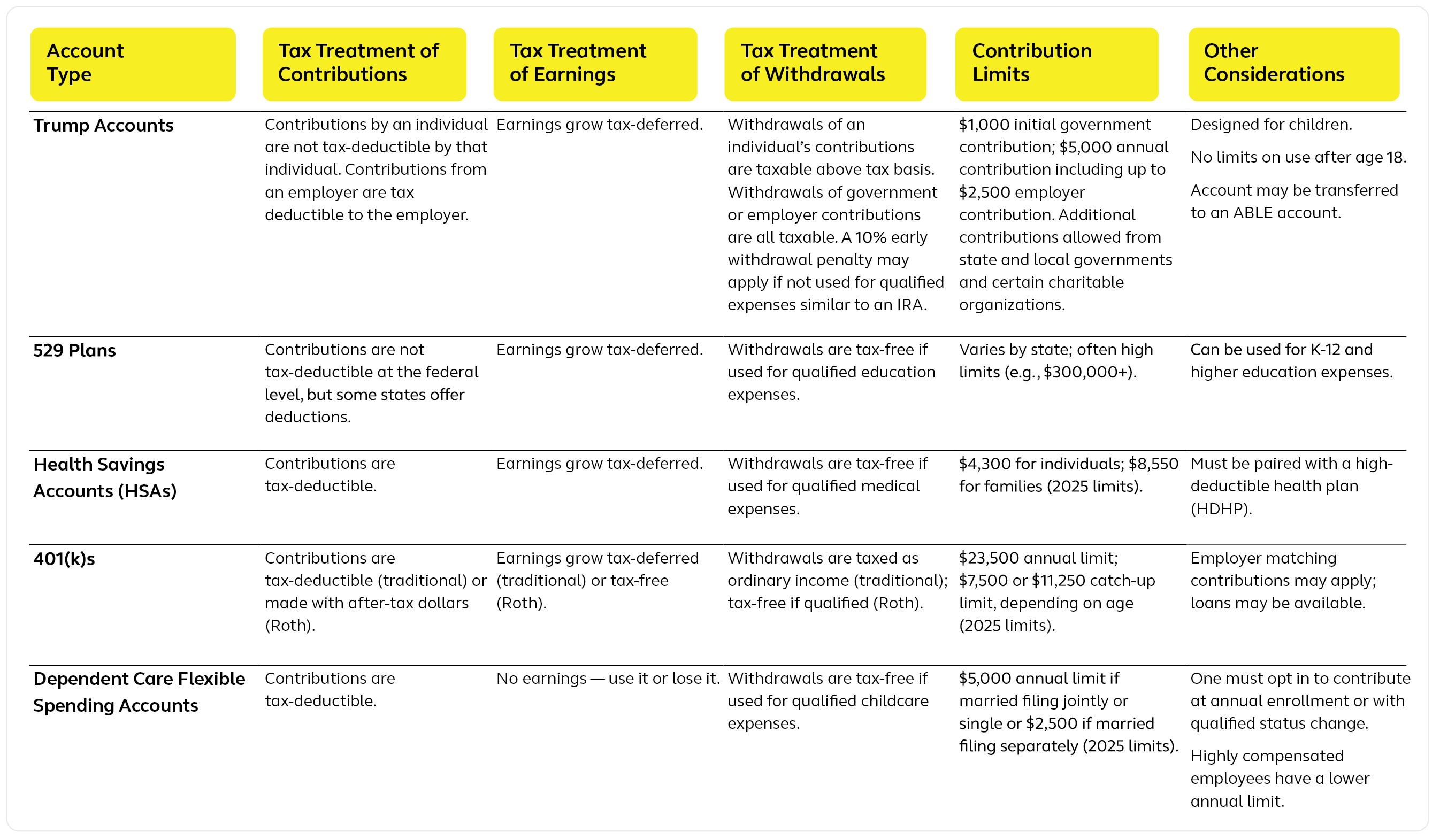

While Trump Accounts offer tax-advantaged growth, their tax benefits are modest when compared to options like 401(k)s or Health Savings Accounts, which provide immediate tax relief by reducing current tax burdens. Contributions to Trump Accounts resemble those made to 529 college savings accounts, where parents invest post-tax funds, allowing for tax-deferred growth until distribution. However, unlike 529s — which allow tax-free withdrawals for education expenses — Trump Account withdrawals after age 18 are taxed like non-deductible IRAs, meaning investment gains and non-taxed contributions (such as those from a government entity and employers) are taxed as ordinary income, and early withdrawals may incur a penalty.

Additionally, tax treatment varies by contribution source: government entity and employer contributions are fully taxable upon withdrawal, while parent contributions require basis tracking. These complexities may make Trump Accounts less appealing for parents prioritizing tax efficiency in their savings strategies.

In an ideal world, parents would fully fund all available savings vehicles. In practice, they often must prioritize between contributing to a Dependent Care Flexible Spending Account (DCFSA), a 529 account and now a Trump Account. The DCFSA typically takes priority due to its immediate tax benefits and coverage of near-term expenses — though it operates on a use-it-or-lose-it basis, so over-contributing can lead to forfeited funds.

If an employer offers a matching contribution to a Trump Account, that may shift the priority toward maximizing the employer match, followed by funding the DCFSA (if needed) and then the 529 account or Trump Account. Ultimately, the best approach depends on each family’s financial situation and savings goals.

Q2: Will employers contribute to Trump Accounts?

A2: Employers may contribute up to $2,500 (indexed) per employee on a tax-free basis.. The legislation does not specify whether this is an annual limit or a one-time contribution, so more guidance is anticipated. Importantly, this limit applies per employee — not per child — and these contributions count toward the $5,000 annual contribution limit. Several companies, including Dell, Uber and Goldman Sachs, have publicly stated their support for contributing to the accounts. However, most employers are still digesting the legislation and have not decided whether to contribute.

For employers, contributions to Trump Accounts are tax-deductible business expenses, similar to those made to retirement plans. That said, employer contributions introduce operational complexity. The law requires that contributions be made under a written program that meets requirements similar to dependent care assistance programs, such as nondiscrimination testing. These contributions also factor into compliance testing.

It’s worth noting that contributions from states, local governments and charitable organizations are also permitted. These contributions will not count toward the $5,000 annual limit.

Q3: Will Alight administer Trump Accounts?

A3: Alight has not yet decided whether to administer Trump Accounts. The decision will depend on the final regulations and client demand. The law indicates that government contributions will be directed to accounts established by the U.S. Treasury. A rollover process will be required to transfer these funds to non-Treasury service providers. This multi-step process, combined with the need for regulatory guidance, introduces complexity to the administration of these accounts. However, we recognize that Trump Accounts may possibly benefit participants, employers and the market, so we are committed to monitoring regulatory developments to assess how they might best be administered.

Conclusion

Trump Accounts aim to encourage early savings — a positive step in public policy. However, their adoption and overall impact remain uncertain. We anticipate further details soon and are prepared to support our clients and their employees in navigating these new options.

Retirement Benefits

Help your people feel good about what's to come for their retirement benefits. We'll show you how.