Answer anything

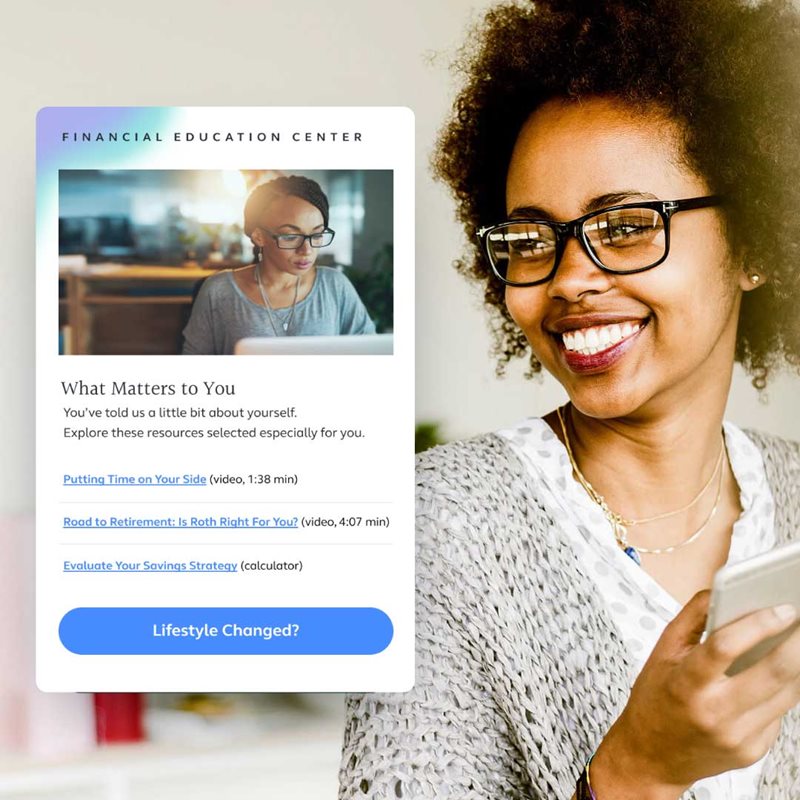

No matter their stage of life or career, your people want to make sure they’re on track to achieve financial wellness. With our help, you can offer the knowledge, tools and personalized support they need to feel confident about the future.

Here’s the Challenge

Financial planning is intimidating

Here’s how we solve it

Help your people take control of their financial future

of workers have a positive perception of their financial health

2021 Employee Wellbeing Mindset Study

of employees are afraid of running out of money during retirement.

2021 Employee Wellbeing Mindset Study

See more of what’s possible with our Financial Wellbeing solution

Personal financial planning

We combine digital and in-person guidance to create a robust, detailed financial plan based on each employee’s unique circumstances and financial goals.

Benefits

- Generate a personalized financial profile with online planning software

- Consult with licensed investment advisors

- Build an individual plan across six key areas (income, savings, retirement, risk, tax, estates)

Benefits planning

We help your people truly understand their retirement and health benefits and how to get the most out of them.

Benefits

- Discover the optimal mix of benefits for employees and their family

- Assess savings strategies and model financial scenarios

- Better understand how insurance can protect from sudden loss of income

Ready to get started?

Learn more about how we can help your business.

Recommended insights

Explore our other solutions

Defined Benefit

Pension planning and administration made easy for you and your people.

Defined Contribution

Guide your people to better financial outcomes and get help managing your plan.