People don’t want more open enrollment choices. They want better ones.

Alight analyzed the open enrollment experiences of over 10 million people to uncover how digital tools, mobile access and tailored guidance are shaping a more supported benefits experience.

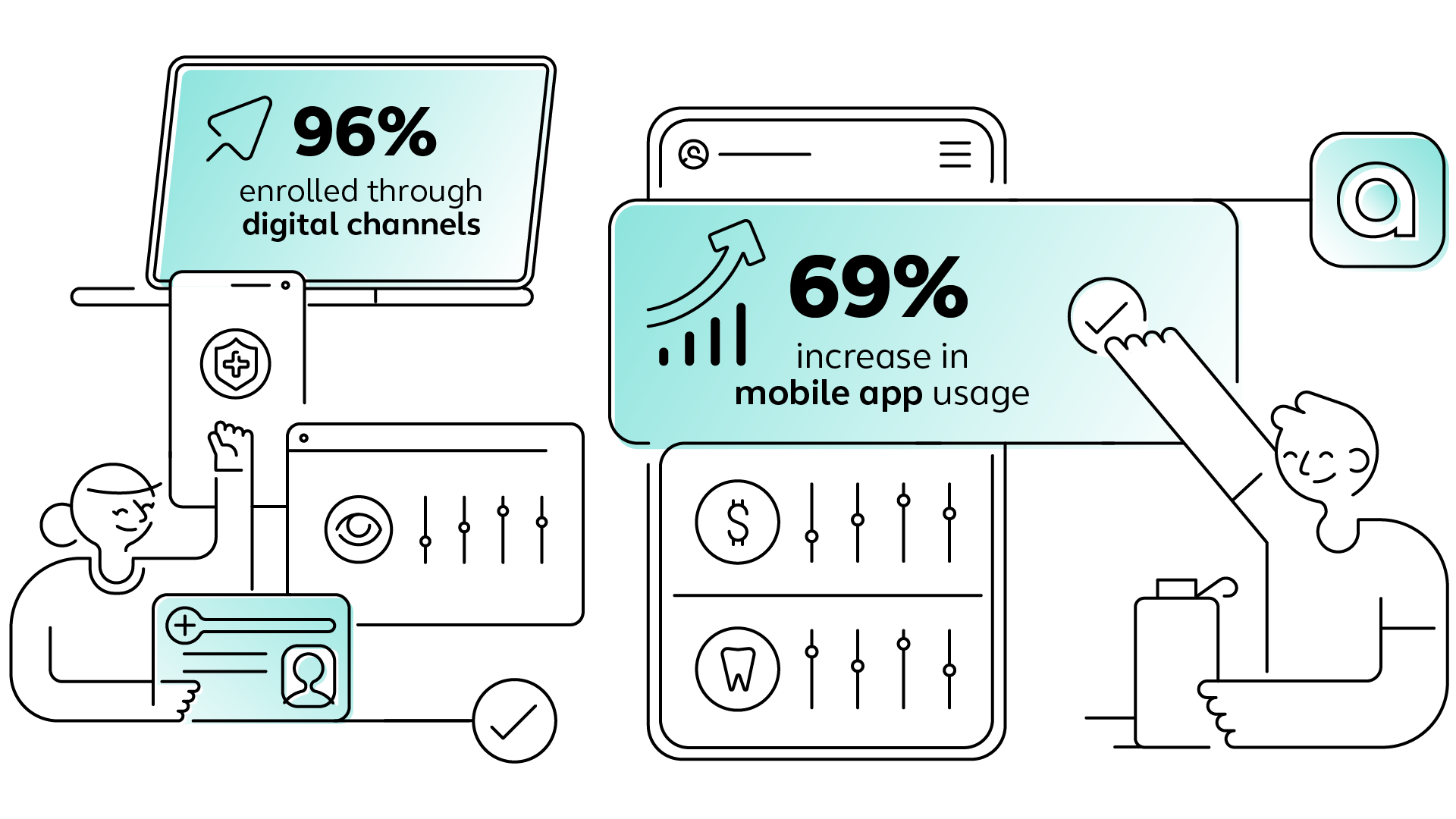

Digital convenience leads the way

Employees are choosing the most convenient path when given options. Mobile tools and on-demand access are helping them enroll on their terms.

Interactive tools turn complexity into clarity

Savings calculators and plan comparisons help employees feel more informed.

Personalized support improves satisfaction

Employees feel better equipped to choose benefits that fit their needs when expert guidance is available.

Employees feel more empowered with support

2/3 of employees with access to support tools felt secure in their plan choices, compared to only 1/2 of unsupported employees.

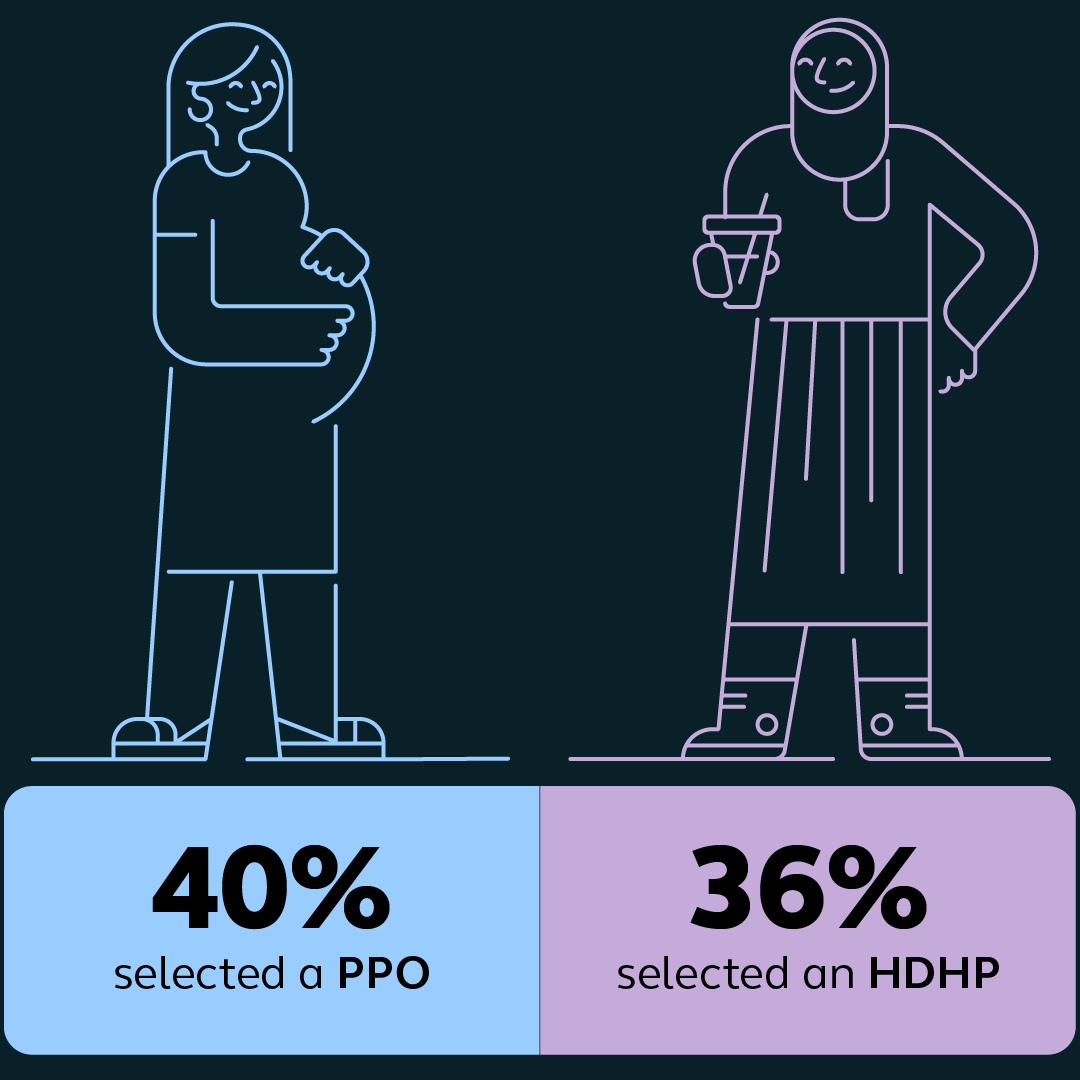

Employees continue to rely on familiar plans that fit their needs

Among the 74% enrolled in employer-sponsored health coverage, PPOs and HDHPs remain the top choices.

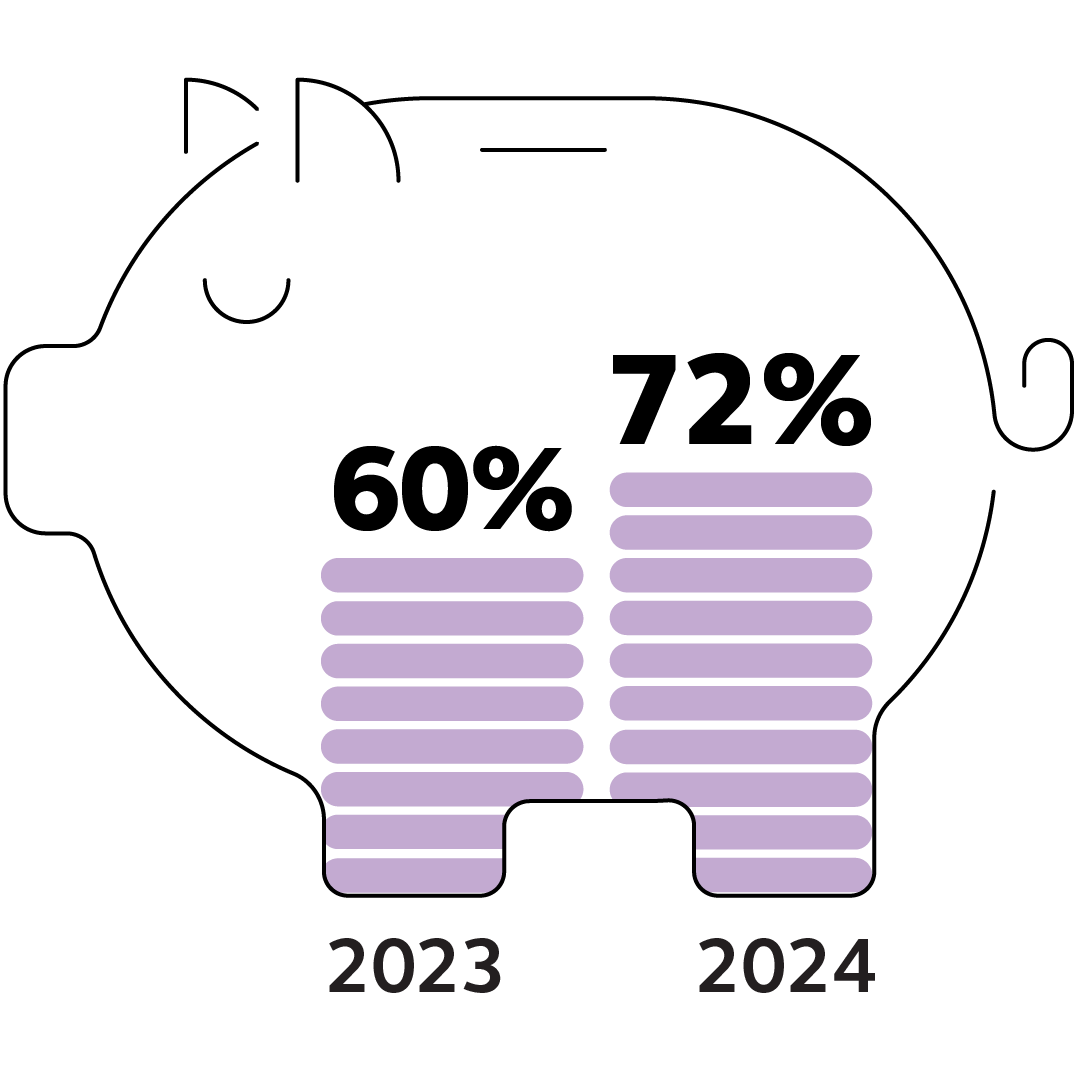

Health Savings Account participation continues to grow

In 2024, 12% more eligible employees turned to HSAs to manage healthcare costs and build long-term financial security compared to 2023.

Life-stage and family structure are shaping voluntary benefit choices

“This year’s open enrollment results exemplify the powerful benefits of combining a technology-driven enrollment experience with personalized support. With today’s workforce becoming increasingly diverse, it’s evident that employers must move beyond a one-size-fits-all approach.”

— Karen Frost, VP, Go-to-Market Strategy, Health