Simply working a little smarter isn't enough — CFOs must focus on embracing a full transformation centered around artificial intelligence in corporate finance.

CFOs and controllers are under more pressure than ever to deliver better business insights, improved controls and compliance, and more efficient transactions processing. They're being pushed to become more global and scalable, and need to be able to maintain operational continuity in the face of catastrophe, including pandemics. These imperatives require a fresh approach to how things are done.

Looking to get started on your Workday Financial Management AI journey?

Talk to an expert

The Evolution of Human Intelligence in Finance

The journey of finance, from traditional methods to AI integration, involves:

- Understanding traditional processes: Recognizing the role of data analysis, discussions, and digital tools in finance tasks.

- Comparing human and AI capabilities: Analyzing similarities between cognitive processes in finance professionals and AI functions.

- Adapting and evolving: Emphasizing the necessity for adaptability in technology to mimic human decision-making.

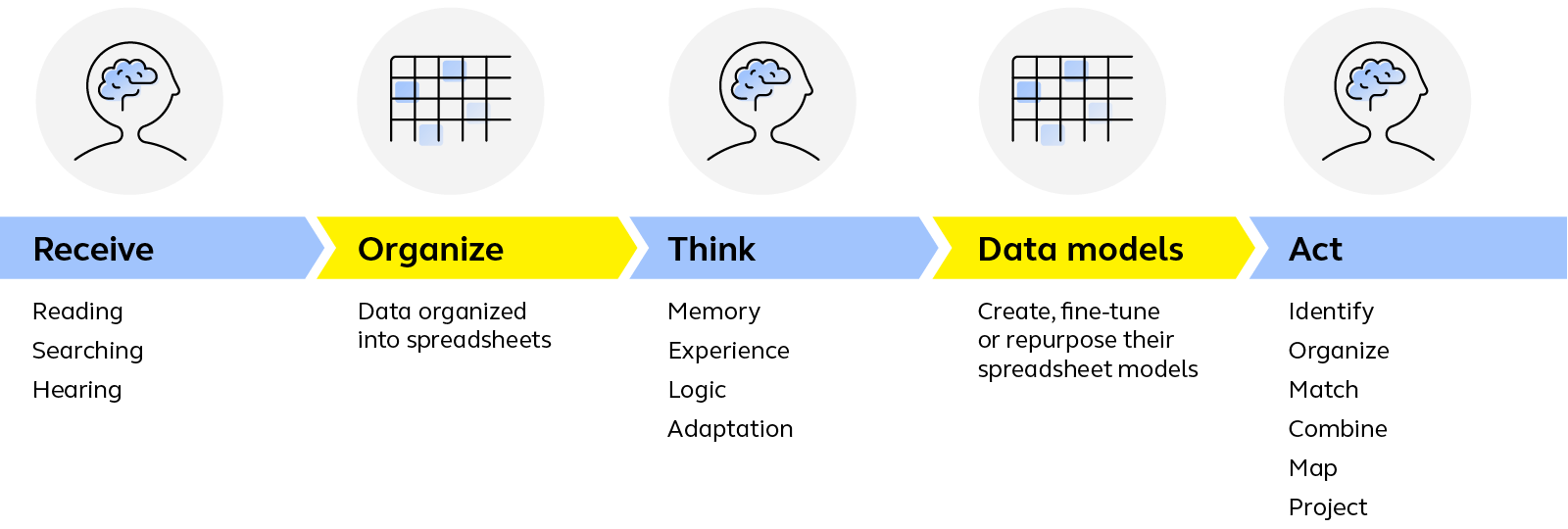

Human intelligence process in finance

The Progression from human to artificial intelligence in finance

As recently as the nineties, the best accountants were known for being great with “numbers”. They could look at a row of numbers and identify combinations that matched a total. They could find outliers simply by eyeballing a dataset and could spot a trend in a sea of digits. But this eyeballing and spotting was not enough. They needed to reconcile accounts and create forecasting documents.

A few years later, spreadsheets were introduced, which not only helped with analyzing data, but also helped to create documents. Being good with numbers was no longer good enough; those who were known as stars in the CFO’s organization had to be good at working within these spreadsheets. These spreadsheet whizzes worked their magic to get all information and data into their spreadsheet models. They would then use their memory, experience, logic and adaptation to fine-tune or repurpose their spreadsheet models.

Their thinking became more efficient and effective as they were constantly building from tangible models with memory and logic built into them.

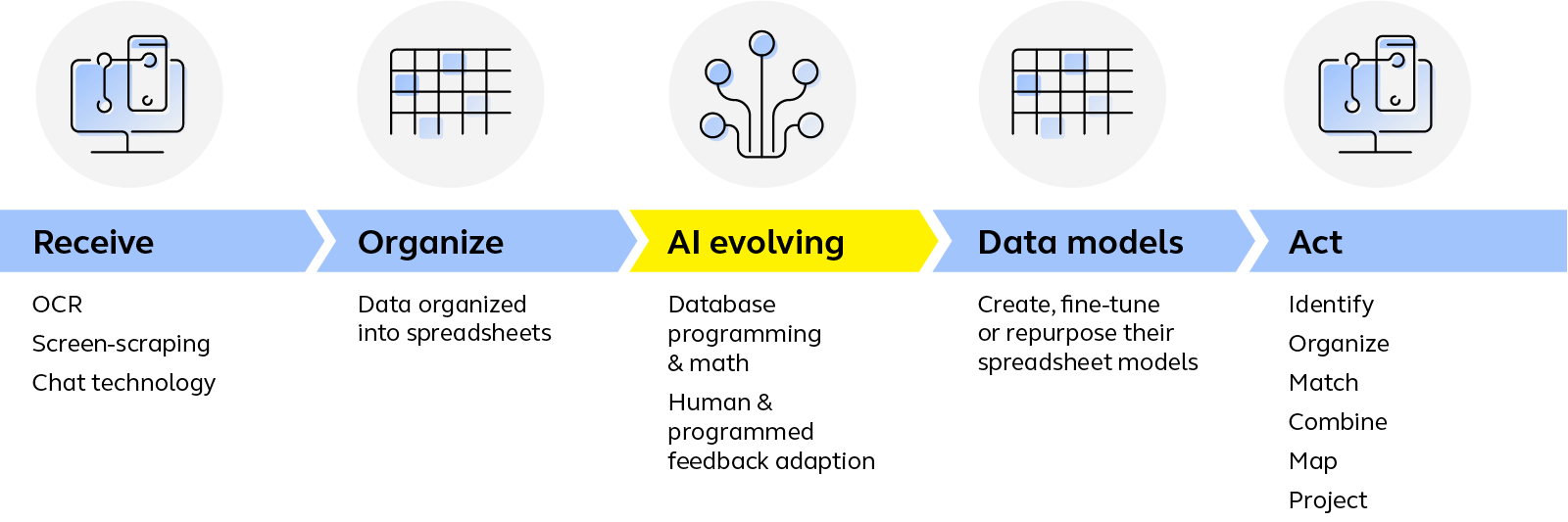

In the past 5+ years, new technology has been introduced to make finance and accounting professionals more efficient, but human intelligence is still required, especially when situations and activities change.

However, AI's growing influence in finance is evident through:

- Advanced data analysis: Aggregating and interpreting extensive datasets to identify trends and make predictions.

- Strategic insights and predictive capabilities: Facilitating strategic planning and foresight with AI-driven analytics.

- Transforming roles and departments: Redefining the CFO's responsibilities and the organizational structure of finance departments.

Where is AI most applicable in finance?

Currently, AI can be applied across many finance and accounting activities. It’s good at figuring out what data it needs if you feed it the whole data universe, and it’s great at combining and matching numbers. It’s also excellent at finding events and data that are statistical outliers and can spot trends and predict future performance. More importantly, when it comes to showcasing its talent in the CFO’s office, AI is excellent at identifying and mapping relationships. Finally, AI has gotten very good at translating characters and words.

With proper prioritization, funding, expertise and underlaying technology, CFOs can really start to employ a hybrid, highly effective/efficient workforce, one with fewer professionals focused on more strategic activities. The number of people needed to perform transactional and routine accounting activities can be greatly reduced. As you review the list below, you can envision how AI can really impact how the CFO’s organization can be redefined.

AI in finance mimicing human intelligence

Embracing AI in Finance: The Path Forward

The adoption of AI in finance underscores a future focused on strategic, high-value activities:

- Optimizing human and artificial intelligence: Leveraging a hybrid workforce to enhance efficiency and innovation.

- AI as a transformative force: Recognizing AI's potential to reshape corporate finance management.

- Strategic integration of AI tools: Utilizing AI-powered ERP systems like Workday for scalable, efficient financial operations.

At Alight, we build and operate digital workers that attach to your Workday tenant. This service helps you fully leverage your Workday investment by converting historically labor-intensive activities into a fully automated, touchless experience. One example of this is our supplier invoice automation for Workday Financial Management where we handle the free-of-charge implementation. Alight owns and manages the AI-powered technology. Our clients simply pay for service consumption and achieve immediate return on investment.

Tune into our Alight Quick Takes episode where we discuss the power of Workday’s machine learning tools and how your organization can leverage them.

Looking to get started on your Workday Financial Management AI journey?

Talk to an expert today.